Risk Management

The risks of business operations impact sustainability factors that are important to the organization’s progress and growth, including all stakeholders along the value chain. Therefore, risk and crisis management minimize the causes of scenarios that may cause damage, as well as decrease the level and magnitude of that damage. If the organization is not able to manage its risks effectively, it will affect its ability to respond to possible crises, as well as its adaptability to both present and future situations.

The risks of business operations impact sustainability factors that are important to the organization’s progress and growth, including all stakeholders along the value chain. Therefore, risk and crisis management minimize the causes of scenarios that may cause damage, as well as decrease the level and magnitude of that damage. If the organization is not able to manage its risks effectively, it will affect its ability to respond to possible crises, as well as its adaptability to both present and future situations.

Management Approach

EGCO Group is aware that risks are inherent to business, and the company is committed to effective risk management, by considering striking a balance between risks and opportunities for stakeholders. This way, risk management not only creates an opportunity to achieve the organization’s targets, but also allows the organization to create sustained value.

In order to identify, assess, and respond to possible risks that may occur in the present, as well as predict possible risks in the future, EGCO Group applies the COSO Enterprise Risk Management Integrated Framework to its organization. The company also set its risk management philosophy to reflect EGCO Group’s beliefs and attitude in managing the different organizational risks as follows:

Risk Governance

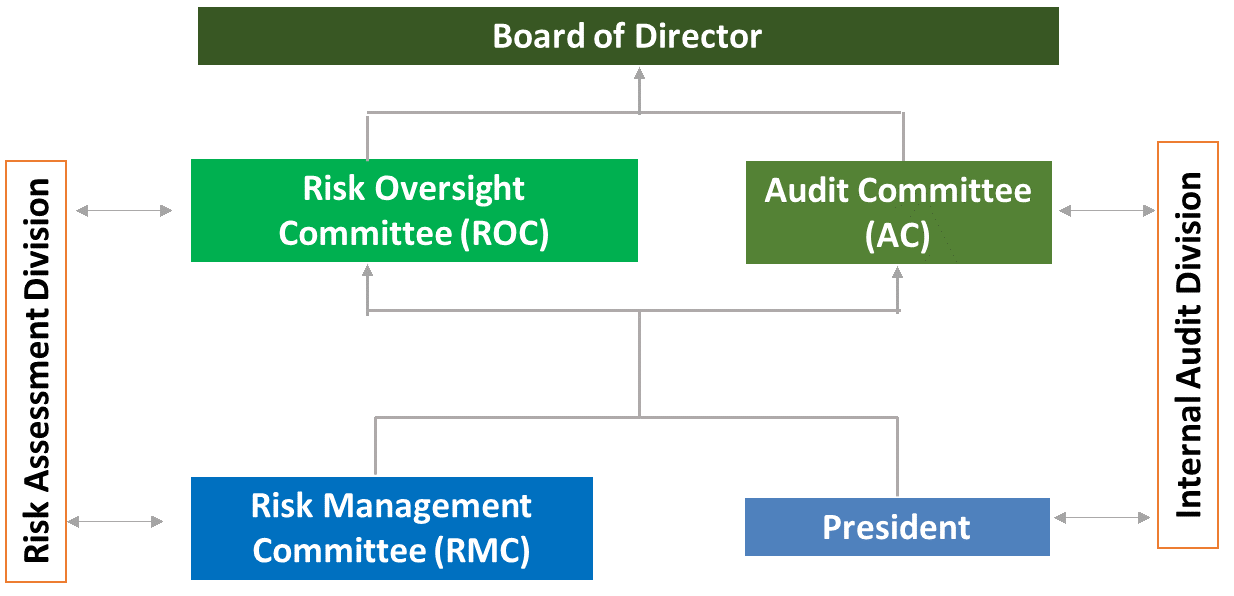

The Risk Oversight Committee’s responsibilities are to consider, review, and provide recommendations regarding the enterprise risk management policy and framework, risk tolerance and risk appetite. It also provides oversight to ensure that key risks are identified, and that the impacts and opportunities are evaluated. The Committee also considers, monitors and assesses the organization’s risk management framework and plans, provides recommendations and support to the Board of Directors and management regarding appropriate and effective risk management that relates to business operations. Lastly, the Committee regularly reports to the Board of Directors on the results of the risk assessment and mitigation measures.

At the management level, EGCO Group has a Risk Management Committee, which consists of a board director as the Committee Chairman, as well as Senior Executive Vice Presidents from all business units as committee members, and Executive Vice President on Asset Management as the committee secretary. The Risk Management Committee oversees that operations are in line with EGCO Group’s risk management policies and approach, promotes and supports risk management activities throughout the organization, including regularly, reporting to the Risk Oversight Committee and Board of Directors on risk management. In the event in which a new risk arises and has a material impact on EGCO Group’s operations, the Risk Oversight Committee must report to the Risk Oversight Committee and Board of Directors promptly.

Risk Management Policy

EGCO Group conducted an additional review of its risk management policy and approach, in order to cover risk issues, in parallel with enterprise-wide risk management. The company focuses on striking a balance between risks and returns, which is an important foundation that will lead the organization towards long-term success, which optimizes stakeholder value.

Emerging Risk